Have them opt out of overdraft protection so they can’t use the card if there’s no money in the account.

#BUDGET PLANNING FOR COLLEGE STUDENTS HOW TO#

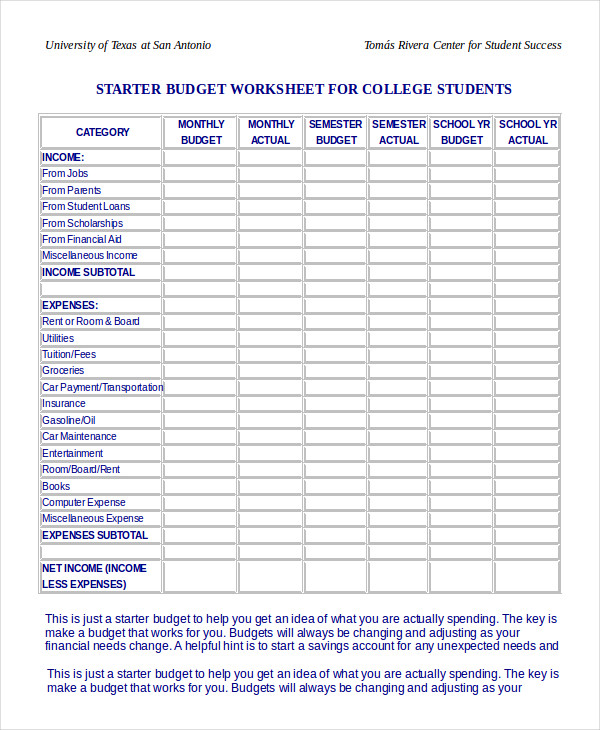

Help your child ease into the credit card world by giving them a debit card and teaching them how to use it. If you decide to add a job to the mix, be sure to look for something manageable - while it's important for college kids to learn about money and budgeting, working too many hours can cause school performance to suffer. Is your child going to work while they are at school? During school breaks? Over the summer? What do you expect, and what are they expected to cover with that money? If possible, it might be easiest to spend the first semester concentrating solely on school and then determine whether your child can handle a part-time job along with their course load. Talk to them about jobs for college students “I worked with a kid who graduated with $19,000 of credit card debt from pizza and smoothies.” 4. “That means the Starbucks, that means the juices, that means the four Frappuccinos in a day,” says Neale Godfrey, founder of the Children’s Financial Network, a company dedicated to the worldwide financial literacy of youth and their parents. Have them track every single purchase, either on paper or using an app, for the first month of school so they can get a feel for the outflow of money. Have them track their spendingĬreating a budget is very different from sticking to one, and kids don’t always realize how much the little purchases add up. “Every child is supposed to be standing on their own two feet, not only as a college student but independently as a person who is managing expenses in this new, independent life.” 3. “I don’t recommend parents do that,” Beacham says. Some parents pay for tuition, room and board but not for, say, books or sorority expenses. “Otherwise, it can become an emotional conversation about what you said you’d do,” says Susan Beacham, founder of Money Savvy Generation, a company that develops financial education products. Make sure to write down what you’ll pay for and what your child will pay for when they're at college. Compare and contrast as the school year progresses.Break it down by month to track expenses.Sit down with them and create a budget on paper that estimates potential expenses for the year. College may be the first time your child will be responsible for managing their own expenses-or at least the first time on a larger scale.

0 kommentar(er)

0 kommentar(er)